Redefining Iran’s role in global arena as new approach to nullify sanctions

Several approaches have been proposed to neutralize sanctions on Iran, including legal action and normalization of relations with the West, bypassing sanctions and issuing instance licenses, using monetary contracts, offshore banking, cryptocurrency and economic reforms.

A study published by the Research Center of the Islamic Legislative Assembly of Iran concludes that none of these approaches are the exact answer to the sanctions, because they do not grasp the depth of what the sanctions have taken away from Iran's economy.

Before the Islamic Revolution in 1979, Iran had forged a special economic relationship with the West, under which it used to sell oil to many countries and receive proceeds from the sales in foreign currencies.

These currencies held in European banks were easily transacted, covering all of Iran’s needs for goods sourced from abroad. In other words, Iran's economy was able to function in the financial and banking ecosystem of the West, and the "petro-life" was in motion.

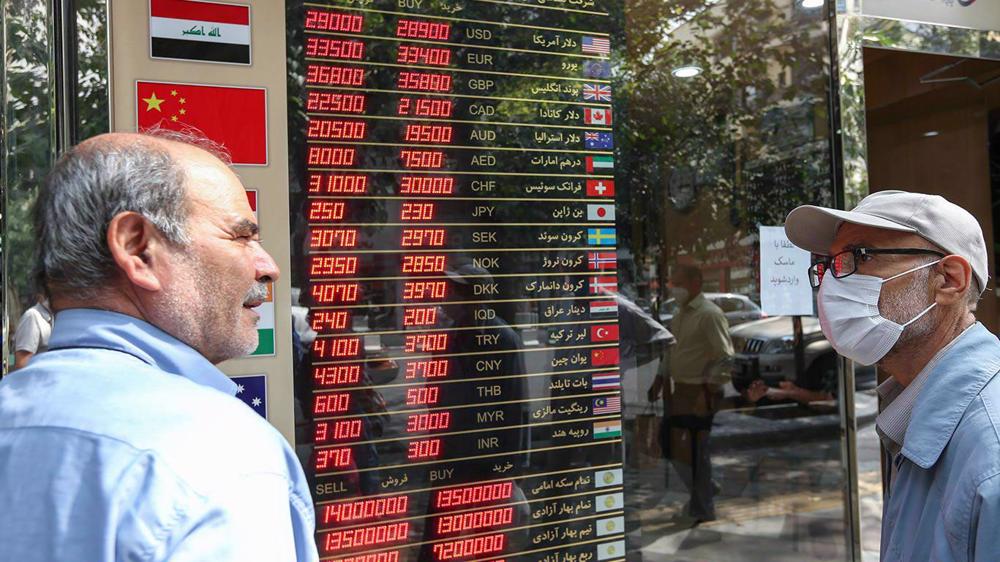

The embargo on Iran's oil exports targeted foreign exchange earnings, and the ban on the banking system disrupted the operations of Iran’s natural and legal entities in the Western banking system.

Based on the above and in view of the extensive geopolitical and geoeconomic changes in the international order, the right answer to the sanctions is "new positioning and redefining of Iran’s role in the international arena", the study concludes.

It examines sanctions against Iran from a different perspective and analyzes the role of various factors, including the nuclear file, Iran's economic and political geography, as well as the shift of US focus from West Asia and “terrorism” to China as the main rival to the United States.

On the eve of 2007, the United States had serious doubts about the extent of its focus on the West Asian region. The rise of China in the years after the Global Financial Crisis prompted the US to follow a policy of moving eastward in order to contain China.

The requirement of such a change was to reduce operational costs in West Asia, but the clear implication of this drawdown was the emergence of a power vacuum in West Asia, where new actors seen as adversarial by Washington such as Iran could step in and fill the gap.

Iran's stepped-up nuclear activities and its new capabilities in this field instilled American politicians with the notion that the power vacuum created in West Asia should not be filled by Iran, which has nuclear technology and regional influence.

As a result, the United States decided to intensify sanctions in 2010 in order to discourage Iran from strengthening its power vectors. Over time, however, another important factor provided the basis for maximum sanctions on Iran, which incidentally benefited the American economy.

According to the study, the US dependence on oil imports and its significant vulnerability to any tightness in the global oil market and the subsequent increase in prices made the maximum sanctions and elimination of Iranian oil from the energy market a costly and impossible option.

However, Washington’s move since 2005 to reform its energy mark through increasing production and commercializing the shale industry plus other producers’ decision to raise output made the gradual exclusion of Iran from the market a possible and available option, so much so that this strategy was implemented in United States’ sanctions act in 2012.

The maximum sanctions on Iran's oil exports in order to disrupt the generation of foreign exchange and the embargo on Iran's banking system with the aim of removing Iranian individuals from the globalized financial system caused the collapse of the mega-deal which Iran’s “petro-life” relied on for decades.

The study, however, cites another important factor that explains the preponderance of the sanctions, seeing them in the context of the global competition of power blocs, foremost the Sino-American conflict.

It explains that the US seeks to destroy or control the main routes of China's Belt and Road Initiative.

Hence, Iran sanctions can be analyzed alongside the emergence of the Taliban in Afghanistan, political instability in Iraq, governance tensions in Pakistan, insecurity in Syria and the collapse of the government in Lebanon.

Based on the alternative solution presented in this report, options such as legal action and normalization of economic relations, circumvention of sanctions and issuance of instance licenses are susceptible to criticism in the face of such tools as monetary contracts, offshore banking and domestic economic reforms.

With regard to the legal action and normalization of economic relations, the report notes that the political will to sanction Iran precedes the legal ground.

As long as the political and economic infrastructure of the embargo exists, the challenges created as a result of the embargo on the way of normalizing trade with international companies and banks cannot be resolved simply with legal recourse.

As for the circumvention of sanctions and issuance of instance licenses, it has been stated that the solution overlooks the durability of the sanctions, where the minimal ratio of the licenses to the many challenges of the sanctions and the minimal level of access to instance licenses make the procedure an inadequate and insufficient option.

The use of monetary agreements and offshore banking at most is attentive to the grand strategy of countering sanctions, and as long as this strategy has not been designed, the procedure is very unlikely to work against the sanctions.

Meanwhile, despite the importance and urgency of reforms in Iran's economy, this approach is not the exact answer to the sanctions. First, it is not an accurate response to currency stress and inflationary shocks (which have disrupted Iran's economic policy), and second, it cannot provide the resources needed for investment.

The study concludes that the answer to the sanctions is nothing but "new positioning and redefinition of Iran's role in the international arena".

This approach, apart from its foreign policy dimensions, will have fundamental effects on domestic policy-making. Such a plan depends on discarding the country's current “petro-life” governance structure.

According to the report, the priority should be producing new high-quality and stable foreign exchange sources by introducing the value and supply chain to the new macro-transactions, attracting targeted and geopolitical investments, moving toward regulating the production and consumption of foreign exchange resources, using local currencies to adjust trade balance with countries and de-dollarizing Iran's economy.

In this regard, it is necessary that Iran's new economic policy be adjusted based on geography, and the country's needs be planned in the form of a strategy of interrelated areas of power.

This is what the study refers to as Iran's strategic initiative which it defines as designing Iran's strategic relationship with the outside world as per projects that accrue economic benefits and create political-security interrelation. These projects must have several basic features.

The projects must be located in interconnected geographical areas and defined in relation to regional and extra-regional value chains, not just bilateral relationships, nor just internal value chains.

This is exactly the present study’s point of difference with regard to the idea of facilitating business relations between countries - the procedure of facilitating the business environment in trade with the interacting countries through the mere strengthening of commercial diplomacy.

The current research believes that the government has a much bigger duty than facilitating bilateral relations in the form of commercial diplomacy and economic consultation (and that at the middle echelon of executive bodies).

Meanwhile, the design of a flexible internal institution with the ability to make decisions and implement them with regard to cross-border projects should be such that, unlike the current approach, it can align several projects with different characteristics.

Also, the industrial development strategy, the development plan for energy lines and logistics routes, and finally the land development plan of the country should be integrated and made compatible with the defined strategic projects that are based on accurate global assessments.

According to the research, the industrial development strategy, the development of energy lines and logistics routes, and the land development plan should be defined with a view to Iran's international position, and not just its geographical area and the internal capacity of the provinces.

Thousands protest Trump’s immigration policies on second term anniversary

Ex-NATO chief slams Trump’s Greenland threats, calls on EU to hit back

US ‘must be held accountable’ for supporting terrorism in Iran: Araghchi

VIDEO | Pro-Palestine protest in Madrid challenges UK repression

Canada PM: World order in ‘midst of a rupture’ from US hegemony

VIDEO | Iron walls: One year of Israel’s largest military operation in Palestine in years

Italian farmers protest EU-Mercosur free trade deal

VIDEO | Russian FM holds annual press briefing, highlighting ‘equality-based’ diplomacy

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website