‘Russia, Iran shielding themselves against US sanctions’

Following the announcement that Russia has agreed to provide Iran with two loans collectively worth $7 billion, analysts say this is part of a new strategy that the two countries have adopted to protect against US-led sanctions in the future.

Jim W. Dean, a managing editor at Veterans Today, has told Press TV that Iran and Russia would be still vulnerable to US sanctions over the next years.

Dean said the stakes for both countries would be particularly high if a “hardline, neocon, extremely pro-Israeli” president is elected to office in Washington next year.

“Anybody else is still vulnerable to what the wild card of what can the US would do in the future particularly if it gets a hardline, neo-con, extremely pro-Israeli president in,” he said.

What testifies this, he said, are the recent remarks by the French Foreign Minister Laurent Fabius that EU countries should be given guarantees from the US that any project they win from Iran, they would not be subject to the sanctions.

Dean said the US businesses are going to lose a lot from the expansion of Iran’s economic relations with Russia and other European countries. He blamed what he described as the “greedy, militaristic foreign policy” of the White House leaders over this.

Dean said relations between Iran and Russia are yet expected to grow in the future.

Russia announced on Thursday that it is preparing to provide Iran with two major loans worth a collective of around $7 billion.

The loans will be provided to Iran under joint plans to develop the country’s infrastructure projects.

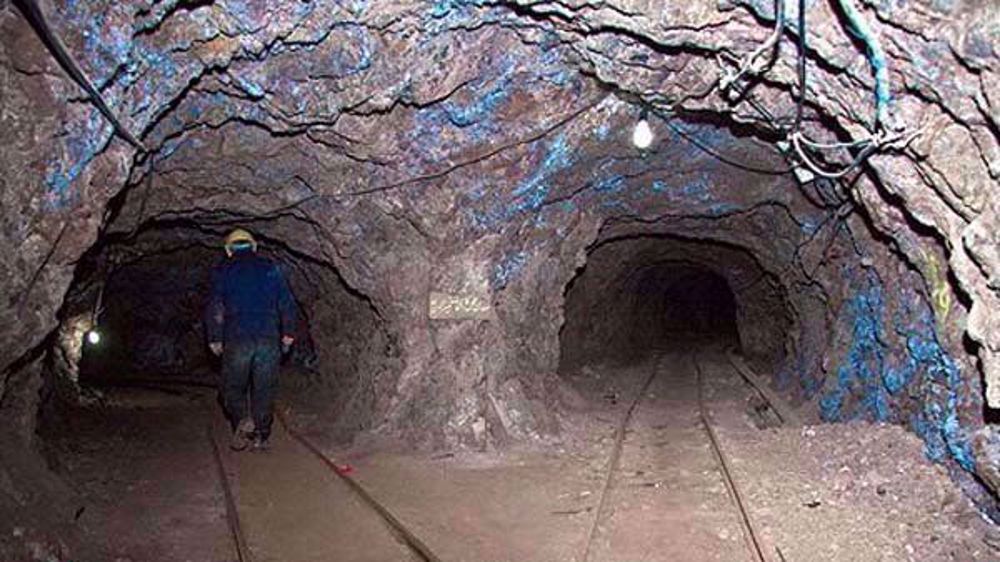

“[Iran and Russia] have got so much to do,” Dean said. “They need to spend a huge amount of money on civilian airlines. They have railroads that they want to put money in. All kind of infrastructure including ports and energy projects”.

He further emphasized that Russia under the scheme of credit lines that has been agreed with Iran will in fact self-fund the projects it takes up in Iran.

“What they are going to do is to self-fund the projects,” Dean said. “They will allocate a credit line for projects and will be paid off over the years. This is very attractive for energy investments because you have all those petrochemical projects in the ground as collateral for the loan,” he added. “So this is a low risk loan”.

VIDEO | Press TV's news headlines

Hezbollah says won’t hesitate to take proper action against aggression

Iran to US: Sanctions and war failed; try diplomacy and respect

VIDEO | Afghanistan-Pakistan tensions rise after cross-border strikes

Israeli settlers set mosque ablaze in West Bank during Ramadan

Nouri al-Maliki vows not to withdraw bid for Iraq’s premiership

OIC calls emergency summit as Israel accelerates West Bank expansion

Israel, not America, first: Carlson’s Huckabee interview lays bare US foreign policy priorities

This makes it easy to access the Press TV website

This makes it easy to access the Press TV website